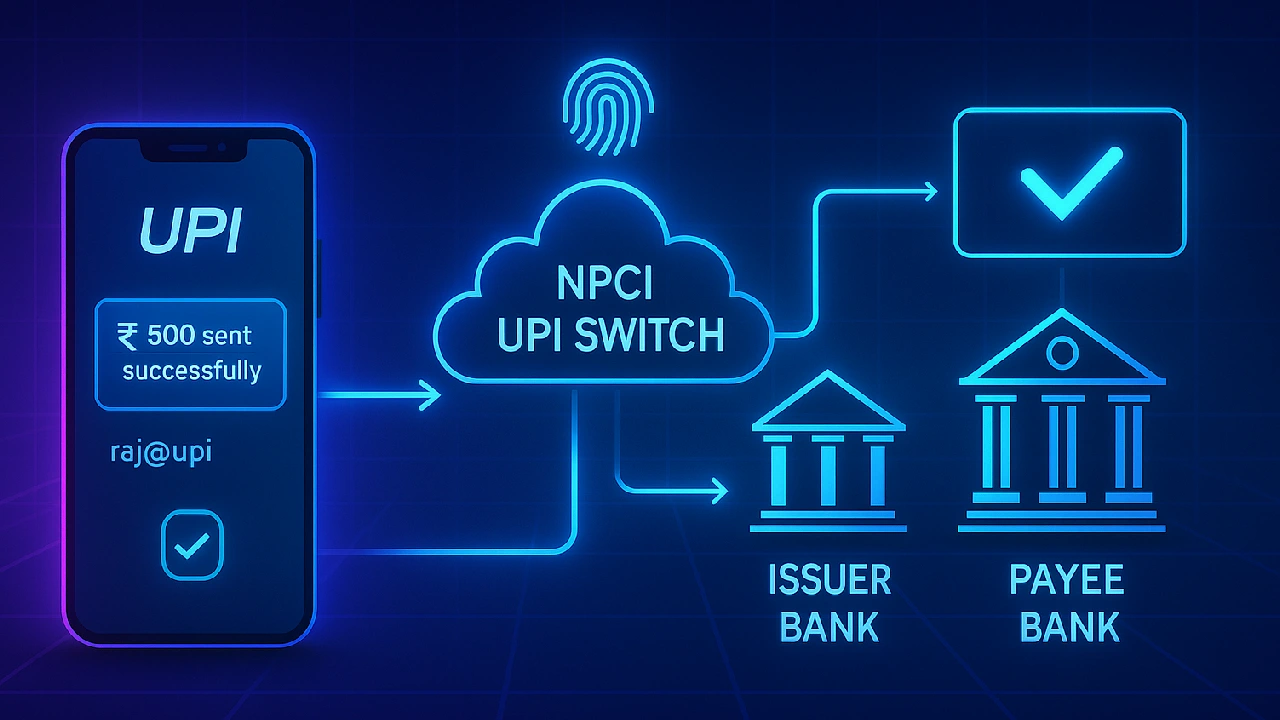

The Unified Payments Interface (UPI) is a real-time payment system that facilitates instant money transfers between bank accounts using a smartphone. Developed by the National Payments Corporation of India (NPCI) and regulated by the Reserve Bank of India (RBI), UPI simplifies digital payments using APIs and secure protocols.

UPI Architecture: The Three-Layered Structure

| Layer | Description |

|---|---|

| Top Layer | User Interface (UI): Mobile apps like PhonePe, Google Pay, Paytm, and BHIM. These are payment service providers (PSPs) that connect users to bank accounts. |

| Middle Layer | UPI Switch (NPCI Layer): The centralized UPI network that routes transactions, validates UPI IDs, and manages debit/credit requests across banks. |

| Bottom Layer | Banking Systems & APIs: Integrates core banking services using IMPS, AEPS, NACH, etc., using stateless REST APIs. |

UPI Transaction Workflow: Step-by-Step (Send Money/Push)

Example: A user sends ₹500 to a friend via UPI.

| Step | Description |

|---|---|

| 1. Initiation | The user opens a UPI app (e.g., PhonePe), selects “Send Money,” and enters the recipient’s UPI ID or scans a QR code. |

| 2. Input Details | The user enters the amount and selects the bank account to debit. |

| 3. Authentication | The user confirms the transaction using their UPI PIN (MPIN). |

| 4. Request Routing | The PSP sends the transaction request to NPCI’s UPI switch, including the payer/payee UPI IDs and amount. |

| 5. Address Resolution | NPCI maps the recipient’s UPI ID to their bank account and PSP. |

| 6. Debit Request | NPCI sends a debit request to the payer’s bank for transaction authorization. |

| 7. Credit Request | Once approved, NPCI sends a credit request to the payee’s bank. |

| 8. Confirmation | Both parties receive real-time confirmation of successful transfer via app notifications. |

Underlying Technology Stack

| Category | Technology Used |

|---|---|

| Databases | Cassandra, PostgreSQL, MariaDB, KeyDB, MinIO (distributed, scalable storage & fast retrieval) |

| Backend Frameworks | Spring Boot (Java), Golang (Go) for APIs and microservices |

| Messaging System | Apache Kafka for real-time messaging and queueing |

| Monitoring | Prometheus, Fluent Bit, Grafana, Kibana for logs, metrics, and system alerts |

| Orchestration | Kubernetes for containerized app deployment and management |

| Cloud Platform | OpenStack, Ubuntu (Linux-based infrastructure) |

| Frontend | Angular for mobile/web UIs |

| Blockchain | Hyperledger Fabric (proposed) for tamper-proof transactions and digital audit trails |

UPI Security Framework

| Feature | Function |

|---|---|

| Two-Factor Authentication | UPI PIN + mobile verification |

| Device Binding | Links app usage to a registered phone and number |

| Encrypted Data Transfer | End-to-end encryption of transaction data |

| AI/ML for Fraud Detection | Monitors suspicious activities using behavior-based patterns |

| Signed QR Codes | Merchant-verified QR to avoid tampering |

| Aadhaar Integration | Used for eKYC and UPI PIN creation |

| Blockchain (Proposed) | Enhances security, auditability, and decentralization |

Scalability & Performance

- Stateless APIs facilitate easy scaling because they do not store session data.

- Asynchronous Processing: Decouples request and response flow for faster throughput.

- High TPS Capability: Can process over 10,000 transactions per second.

- API-Driven: Easily integrated with new apps and services.

Intelligent Features (UPI 3.0 & Beyond)

| Feature | Description |

|---|---|

| Conversational Payments | AI-based voice commands for payment (multi-language support) |

| Credit Line Integration | Link pre-approved credit to UPI apps |

| NFC Tap & Pay | Contactless payments via NFC terminals |

| UPI Vouchers | Cashless prepaid vouchers for offline users |

| UPI Circle | Delegate payments to family/friends with spending limits |

| Advanced AI Suggestions | Smart recommendations based on spending history |

Summary: Why UPI Works So Well

| UPI Strength | Explanation |

|---|---|

| Instant Payments | Real-time settlement between bank accounts |

| Interoperability | Works across banks, apps, and platforms |

| Security | Multi-layered protection with PIN, encryption, AI, QR signatures |

| Scalability | Built with stateless APIs, Kafka, and containerized infrastructure |

| User-Centric | Supports QR, mobile number, VPA, Aadhaar, voice |

| Regulatory Backing | Developed by NPCI, regulated by RBI |

| Open API Ecosystem | Encourages fintech innovation through PSPs |