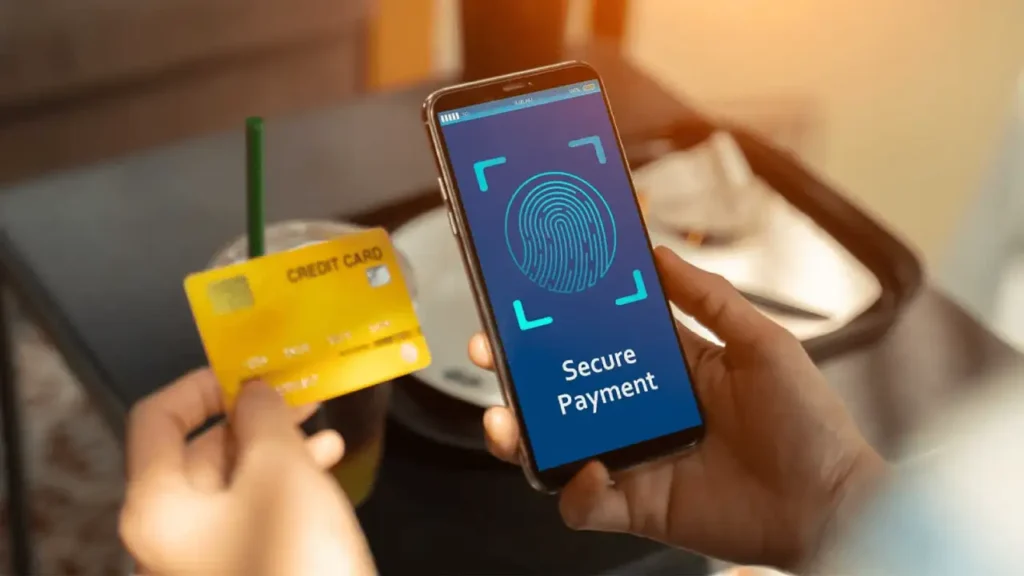

Biometric verification for e-commerce is a safe way to pay online that lets users confirm purchases with their fingerprints or faces instead of OTPs. RBI-compliant 2FA is used by Federal Bank’s system to make purchases faster and easier in merchant apps.

Biometric identity for online shopping is no longer something that will only be possible in the future. With the help of M2P Fintech and MinkasuPay, Federal Bank has made a new biometric option for card payments that is now live in India. This isn’t just a small improvement; it’s a big step toward using your palm or face to safely and easily buy things online.

Take a look at what this tech is, how it works, and why it might make shopping online very different.

What Is This New Biometric Payment System?

It is India’s first biometric authentication option for online card transactions, which was released by Federal Bank. Instead of using OTPs or passwords, this system lets you verify purchases using the fingerprint reader or Face ID on your phone. You don’t have to download an app or wait for an SMS.

It’s basically a 2-Factor Authentication (2FA) method that works with the RBI and is meant to be safe, quick, and easy to use. This solution is made to work within the merchant app, using the card saved in your digital wallet. It doesn’t matter if you’re buying a trip on EaseMyTrip, a prescription from Netmeds, or a train ticket through Ixigo.

How It Works: Step-by-Step Flow

The setup is surprisingly simple:

- Setup Phase: You activate the feature within a partner merchant app. Your registered phone number must match your Federal Bank records.

- Receive Setup Code: A one-time setup code is sent to your number to verify the link.

- Biometric Binding: Your device’s Face ID or fingerprint is securely linked.

- In-App Checkout: When checking out on that merchant app, choose your tokenized card.

- Authentication Prompt: You’ll instantly get the biometric screen — just scan and pay.

- Fallbacks and Control: Not comfortable? Use a static 4-digit Pay PIN or even an OTP as fallback.

- Device-Specific: You need to re-enable biometrics on new devices using the setup code again.

Key Security Note: Biometric 2FA is enabled only on devices that were authorized at the time of setup. If you change your biometric (e.g., add a new fingerprint), re-verification is mandatory.

Why It’s Better Than OTPs and Passwords

Here’s how it compares to typical authentication:

| Method | Time Taken | Friction Level | Security Level | Success Rate |

|---|---|---|---|---|

| OTP via SMS | 45–60 sec | High | Medium | Medium |

| Passwords & PINs | 30–40 sec | Medium | Medium | Medium |

| Biometric 2FA | 3–4 sec | Low | High | High |

Where You Can Use It

This system is currently active for Federal Bank debit and credit cards in partner apps like:

- EaseMyTrip

- Ixigo

- Netmeds

Supported card variants include Celesta, Imperio, and Signet across Visa, Mastercard, and RuPay (credit card support rolling out soon).

Supported Devices:

- Android 5.0+ with fingerprint sensor

- iPhones with iOS 13+ (Face ID/Touch ID

Not available on web browsers: only works inside apps

What the Experts Are Saying

“This is a transformation in digital banking and sets a national benchmark for frictionless, secure digital transactions.”

– Virat Sunil Diwanji, National Head – Consumer Banking, Federal Bank

“We’re delivering scalable, secure infrastructure that elevates digital payment UX across India.”

– Madhusudanan R, Co-founder, M2P Fintech

“The world’s best security doesn’t have to be complicated — we’ve made it intuitive and human.”

– Anbu Gounder, CEO, MinkasuPay

Final Thoughts

Biometric identification for online shopping isn’t just a new piece of technology; it’s a change in how people act. With Federal Bank, M2P Fintech, and MinkasuPay leading the way, soon enough, your fingerprint could be the fastest and safest way to pay online.

If you shop online, would you try fingerprint authentication? Tell us.