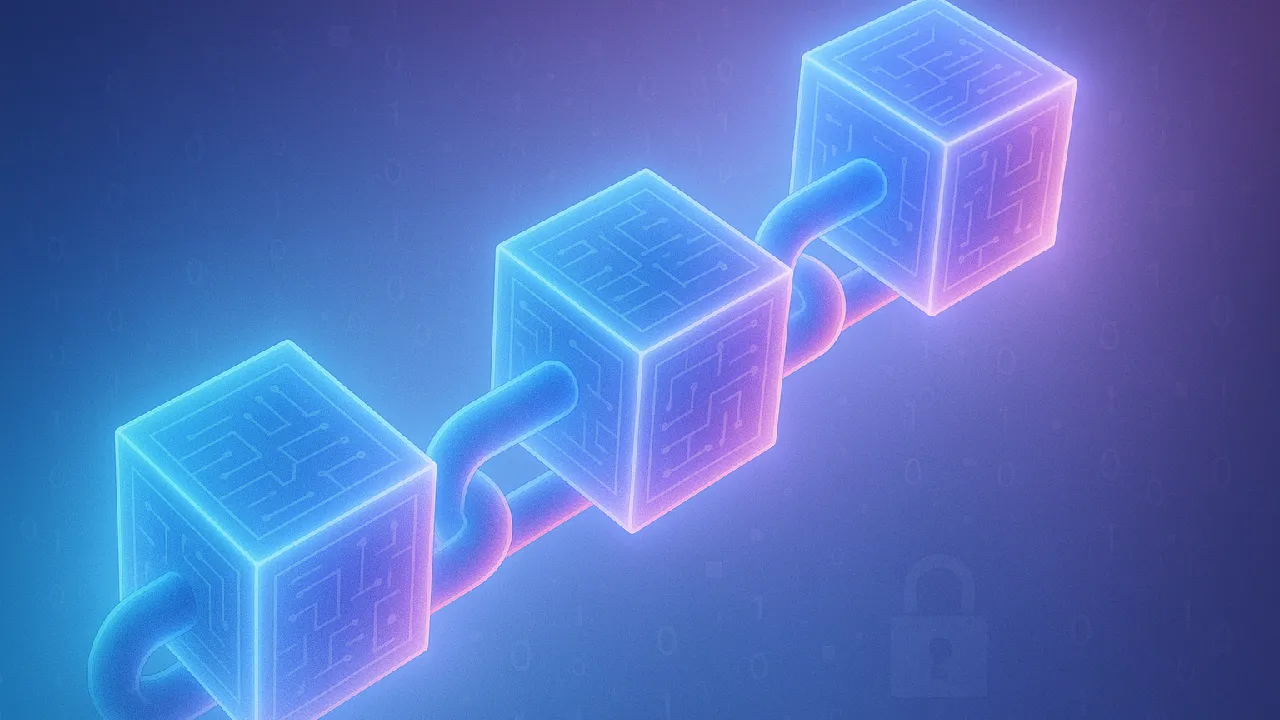

Blockchain enables cryptocurrencies by enabling safe, transparent, and tamper-proof transactions without banks or intermediaries.

Blockchain technology serves as the foundation for cryptocurrencies. Blockchain, unlike traditional financial systems, is a decentralized digital ledger that records transactions in a secure and transparent manner. It eliminates the need for intermediaries, secures trust with cryptography, and enables peer-to-peer transactions. This technology drives Bitcoin, Ethereum, and many more digital currencies that will shape the future of money.

What is Blockchain Technology in Cryptocurrencies?

Blockchain is the foundation of cryptocurrency. It is a distributed ledger system that stores data in blocks and links them together in a chain. Each block includes transaction data, a timestamp, and the previous block’s cryptographic hash, which ensures the chain’s security and immutability.

Blockchain technology ensures that every transaction in cryptocurrencies such as Bitcoin is verified and logged by thousands of nodes (computers) throughout the world. This makes it decentralized and less susceptible to fraud or manipulation.

Key Features of Blockchain in Cryptocurrencies

- Decentralization – No central bank or authority controls the system. Instead, a network of nodes validates transactions.

- Transparency – Every transaction is visible on the blockchain, ensuring accountability.

- Security through Cryptography – Public and private keys secure transactions, while hashing makes records tamper-proof.

- Immutability – Once data is added to the blockchain, it cannot be altered, preventing fraud.

- Consensus Mechanisms – Proof of Work (PoW) or Proof of Stake (PoS) ensures that all nodes agree on the validity of transactions.

How Blockchain Works for Cryptocurrencies

- A user initiates a transaction (e.g., sending Bitcoin).

- The transaction is verified by nodes in the network.

- Verified transactions are grouped into a block.

- Miners (or validators in PoS) confirm the block using cryptographic algorithms.

- The block is added to the blockchain, becoming a permanent record.

- The recipient receives the cryptocurrency securely.

This process ensures trust without banks or intermediaries.

Why Blockchain Matters for Cryptocurrencies

- Security First – Blockchain eliminates double-spending and makes hacking extremely difficult.

- Financial Freedom – Anyone with internet access can send and receive money globally.

- Low Costs – Peer-to-peer transactions reduce fees compared to traditional banks.

- Innovation Beyond Money – Blockchain powers smart contracts, decentralized finance (DeFi), NFTs, and more.

Comparison: Blockchain vs Traditional Banking

| Feature | Blockchain | Traditional Banking |

|---|---|---|

| Control | Decentralized | Centralized by banks |

| Transparency | Public ledger | Private records |

| Security | Cryptography + hashing | Regulatory + legal |

| Speed | Minutes (crypto) | Days (cross-border) |

| Accessibility | Global, anyone | Limited, requires account |

Who Should Use Blockchain-Powered Cryptocurrencies?

- Investors looking for digital assets beyond stocks and gold.

- Businesses accepting global payments with lower fees.

- Developers building decentralized apps (dApps) and smart contracts.

- Individuals in developing countries seeking financial inclusion without banks.

Consensus Mechanisms in Cryptocurrencies

Consensus mechanisms are the rules that blockchain networks use to validate transactions. The two most common are Proof of Work (PoW) and Proof of Stake (PoS).

- PoW (used by Bitcoin) requires miners to solve complex mathematical problems. This ensures high security but consumes a lot of energy.

- PoS (used by Ethereum after “The Merge”) selects validators based on how many coins they “stake” as collateral. This method is energy-efficient and faster than PoW.

These mechanisms ensure that all participants agree on the state of the blockchain, preventing fraud and double spending.

Smart Contracts and Beyond Cryptocurrency

One of the most powerful innovations of blockchain is the smart contract. A smart contract is a self-executing program stored on the blockchain that runs automatically when certain conditions are met.

For example, in a decentralized marketplace, a smart contract could automatically transfer funds to a seller once a buyer confirms product delivery. This removes the need for middlemen like banks, notaries, or lawyers.

Beyond money, smart contracts power entire ecosystems like DeFi (Decentralized Finance), NFTs, supply chain tracking, and even voting systems—showing how blockchain extends far beyond just cryptocurrencies.

Final Take

Blockchain, a secure, transparent, and decentralized system that is changing the way money and trust work in the digital age, is at the heart of cryptocurrencies. From Bitcoin to Ethereum, blockchain assures that cryptocurrencies continue to be the most disruptive invention in finance today.